The lure of an online shopping cart is often impossible to ignore. While online shopping is entertaining and useful, in extreme cases, it can turn into an addiction

Tag: get rich

Getting a Mortgage with a Debt Management Plan

If you’re struggling with debt, a debt management plan (DMP) can help you consolidate and manage your payments, making debt more manageable and often reducing interest rates. But

Can I Pay Off My Debt Management Plan Early? What You Need to Know

Paying off debt can feel like a never-ending challenge, but a debt management plan (DMP) offers a structured path to help you tackle it. One common question we

How to Manage Your Money Better: 8 Steps for Improved Finances

They say money can’t buy happiness, but there’s definitely a link between basic financial stability and the ability to focus on living your life. No matter how much

Credit Cards Debt Relief: Practical Steps to a Brighter Future

Credit card debt can be a huge burden on families and individuals. Many people rely on credit cards for everyday purchases, and sometimes it’s easy to spend more

Applying for a Mortgage? 7 Things to Know Before You Start

Considering buying a home? A lot of folks view home ownership as a significant goal and milestone – and with good reason: When you own a home, you

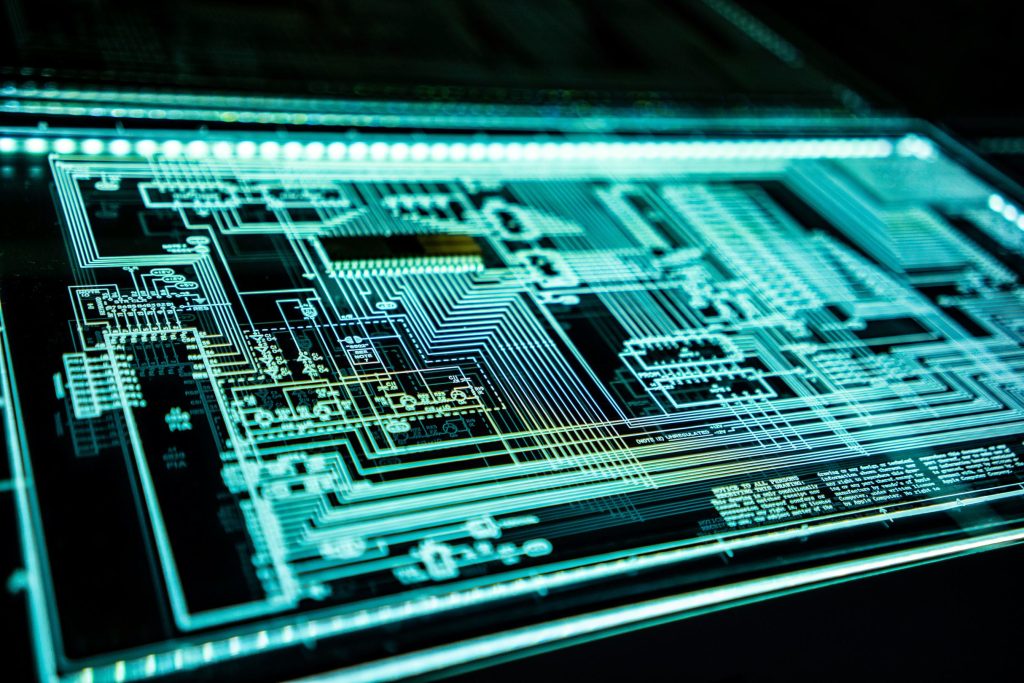

Stay Secure: Mastering Cyber Safety in a Digital World

Whether you’re using your devices for work or just for fun, making sure everything stays secure is more important than ever. It doesn’t take much for cyber-criminals to

How Credit Cards Become Debt Traps

It’s estimated that some 60 million American households regularly carry outstanding credit card balances. According to a WalletHub study, the average household’s credit card balance is $8,425. We

Guidelines for Spending on Your Mortgage

So, you’ve decided to take the leap and buy a home. Congratulations! But have you given some thought to what kind of mortgage you can afford? Think about

How to Break the Paycheque to Paycheque Cycle

Almost half of Canadians live paycheque to paycheque. Learn practical steps to cut costs, build savings, and break the cycle—so you can take control of your money. The