When a loved one passes away, there is no shortage of emotions and responsibilities to manage. Along with grief, family members often face the practical concerns of handling

Dealing with Debt

Debt Management Success Story for First-Time Renters: Katie’s Journey paying Off credit card and payday loan Debt

As a first-time renter juggling high living costs and multiple debts, Katie felt trapped — until the right support helped her turn things around. Her story shows what’s

How to Lower Fixed Expenses on Your budget When You’re paying Off Debt

Setting a budget and trimming down monthly expenses are key priorities for anyone working on paying off debt. While there’s so much emphasis out there on cutting back

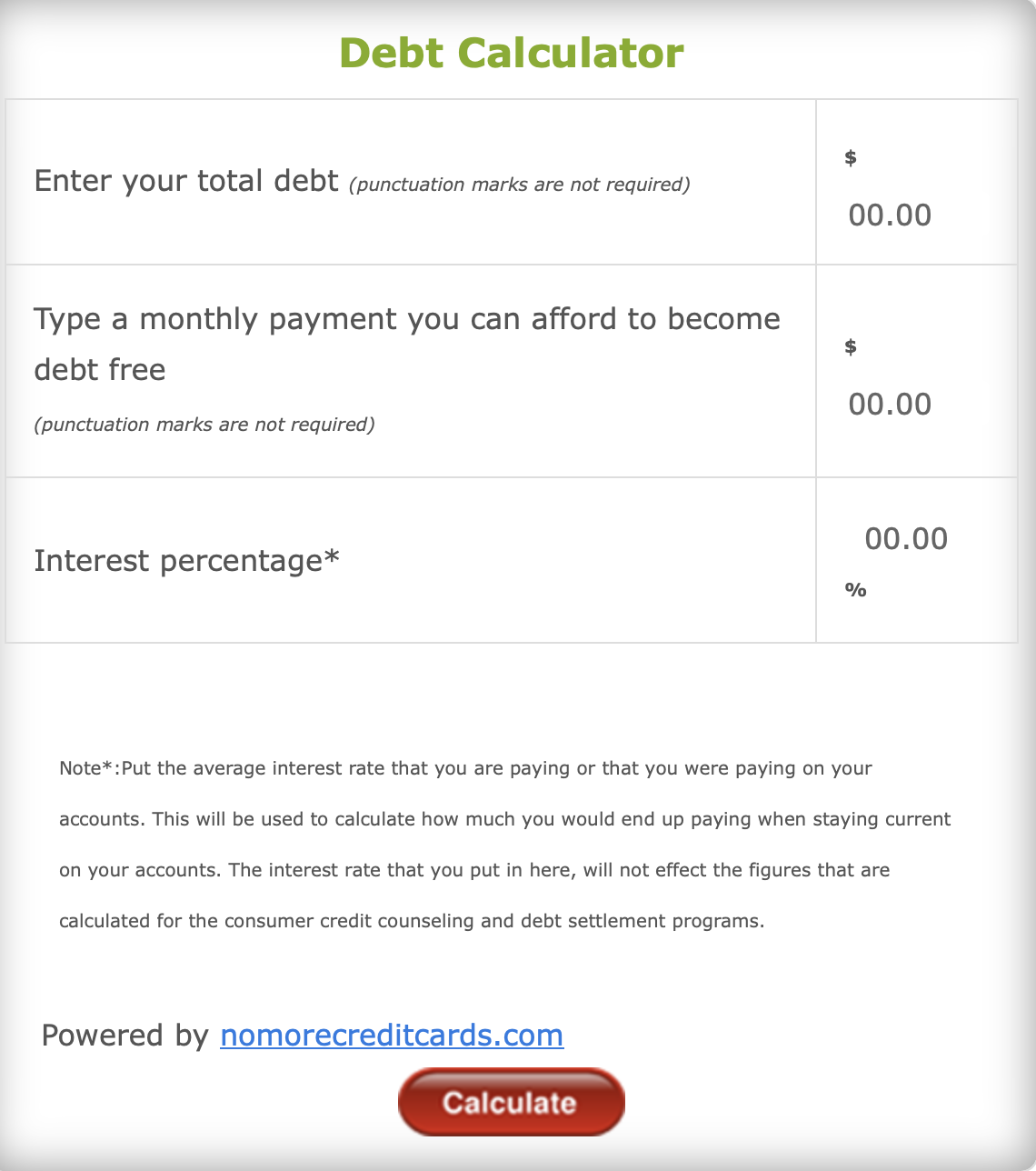

New Debt Calculator Added to Rescheduledebt.com

🎉 New on Our Website: The Free Debt Reduction & Relief Calculator If you’ve ever wondered how long it will take to pay off your debts — or

Debt Management Programs vs. Debt Settlement: What’s The Difference?

If you’ve been struggling with credit card bills, loan payments, and mounting interest, you’ve probably searched for solutions online. Two common terms that often pop up are Debt

Why A Debt Management Program Is A Smart And Safe Choice For Debt Relief

When you’re feeling overwhelmed by debt, it’s easy to get discouraged or confused by the number of debt relief options available. Debt settlement ads promise to slash what

How Consumers Can Use AI To Save money And Get Out Of Debt

Artificial Intelligence (AI) is no longer just a buzzword for techies and large corporations. It’s rapidly becoming part of everyday life—from helping you write emails to powering your

Digital Wallets & The Psychology Of Spending In A Cashless Society

Gone are the days when cash was king. Today, a growing number of Americans are leaving their wallets at home and bringing their smartphones instead. Thanks to digital

How Caregivers Can Manage Debt While Caring for a Family Member: Tips for Financial Wellness

Caring for a loved one can take a toll on your finances, especially if you’re also managing personal debt. This blog shares practical tips to help caregivers balance

How to Deal With Debt in Your 20s in 2025

Student loans, rent, groceries – and don’t forget your beer money! Finding your financial footing in your 20s isn’t easy. Here’s a look at the key steps Gen